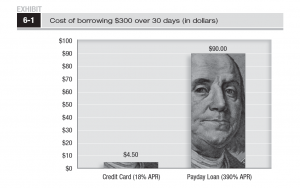

The other day a college student who works for LifeBound was talking about taking out a payday loan. His school put a hold on his account until he could pay his bill and he felt he had a limited amount of choices to get money quick. We cringed and pointed to Chapter 6 in Dollars & Sense: How to Be Smart About Money, Avoiding Financial Pitfalls where we cover loan options. The annual percentage rate is usually around 390% on a payday loan. It’s fast money that’s meant to be paid back at equal speed; otherwise, you’re signing up for debt. The following table is from Dollars & Sense and shows the cost of borrowing $300 over a 30 day period (click on the image to enlarge).

The following activity shows students the loan options they have and asks them to choose which is the best loan for the situation.

____________________________________________________________________________________________

Materials:

- Writing materials

Grade:

- High school

Description:

- Students are given various scenarios and asked which loan option is the smartest option.

Loan Options and Definitions:

- Payday Loan: Small, short-term, high-interest loan intended to cover the borrower’s expenses until the next payday. The payback period is typically two weeks and the annual percentage rate is usually 390 percent. The monthly interest rates are generally 15 percent. There are 26 two-week periods in a year, that’s 15 percent x 26 or 390 percent APR.

- Pawnshop Loan: Small, short-term, high-interest loan requiring collateral that the pawnbroker holds. The pay back period is typically 30 days and the annual percentage rate is usually 195 percent. Monthly interest rates range between 10 and 20 percent. For this exercise, the interest rate for a 30 day payback period is 15 percent.

- Credit Card. The billing cycle for a credit card is typically 30 days. APRs vary from card to card. For this exercise, the APR is 19 percent.

1. Your car breaks down and not getting it fixed is not an option. The mechanic says it’s going to cost $300. You don’t have the cash to foot the bill so you have to choose a loan option. You figure you can pay the balance off in two months. Calculate the cost for each type of loan. Which loan option do you choose?

Example solutions

Payday loan:

- 15 % = .15

- $300 x .15 = $45 interest for two week period

- $45 x 4 (there are 4 two-week periods in 2 months) = $180 in interest over a 2 month period

- $300 + $180 = $480

Pawnshop:

- 15% = .15

- $300 x .15 = $45 for one 30-day period

- $45 x 2 (amount of 30-day periods needed to payback) = $90 in interest over a 2 month period

- $300 + 90 = $390

Credit Card

- 19 %/ 12 months = 1.58% monthly interest rate

- 1.58% = .0158

- $300 x .0158 = $4.74

- $4.74 x 2 (amount of months needed to payback) = $9.48

- $300 + $9.48 = $309.48

2. It’s been a cold winter and the energy bill proves it. You owe $400 or they’re going to shut it off, but you won’t have the money until the end of the month. Calculate the cost for each type of loan. Which loan option do you choose?

3. It’s your first semester of college and you didn’t realize how expensive college texts were going to be! You have $650 worth of books for this semester. Calculate the cost for each type of loan. You’ll have enough money to pay it off in six months. Calculate the cost for each type of loan.Which loan option do you choose?

For a classroom worksheet of The Real Costs of Borrowing Money, click the link for a printable pdf.

After students complete the exercise, have a discussion about ways they can avoid taking out loans with high-interest rates. Some alternatives are:

- Speaking to the creditor about a payment plan.

- Borrowing from friends and relatives.

- Getting an advance from an employer.

- Finding a higher paying job, getting an additional job, or working more hours.

For more financial literacy lessons for teens, check out LifeBound’s newest book Dollars & Sense: How to Be Smart About Money.